VDA(Crypto) Taxation & updates

By CA CS Nitin M. Mantri | Learning BTC – ₿

With the rapid rise in cryptocurrency adoption, India’s tax authorities have taken a definitive stance by introducing a clear framework to govern Virtual Digital Assets (VDAs). Whether you’re a trader, investor, miner, or crypto enthusiast, it’s crucial to understand your tax obligations.

VDA was introduced and defined in the Finance Act, 2022 to regulate the taxation of digital assets such as cryptocurrencies and NFTs.

💡 What is a VDA?

A Virtual Digital Asset refers to:

Any digital information, code, token, or number generated via cryptographic means that represents value and can be transferred, stored, or traded electronically.

✅ Common examples:

- Bitcoin (BTC), Ethereum (ETH)

- Solana (SOL), Cardano (ADA)

- Stablecoins (e.g., USDT, USDC)

- NFTs (Non-Fungible Tokens)

❌ Not included:

- Indian Rupee (INR)

- Foreign fiat currencies

- RBI-issued CBDC (e₹)

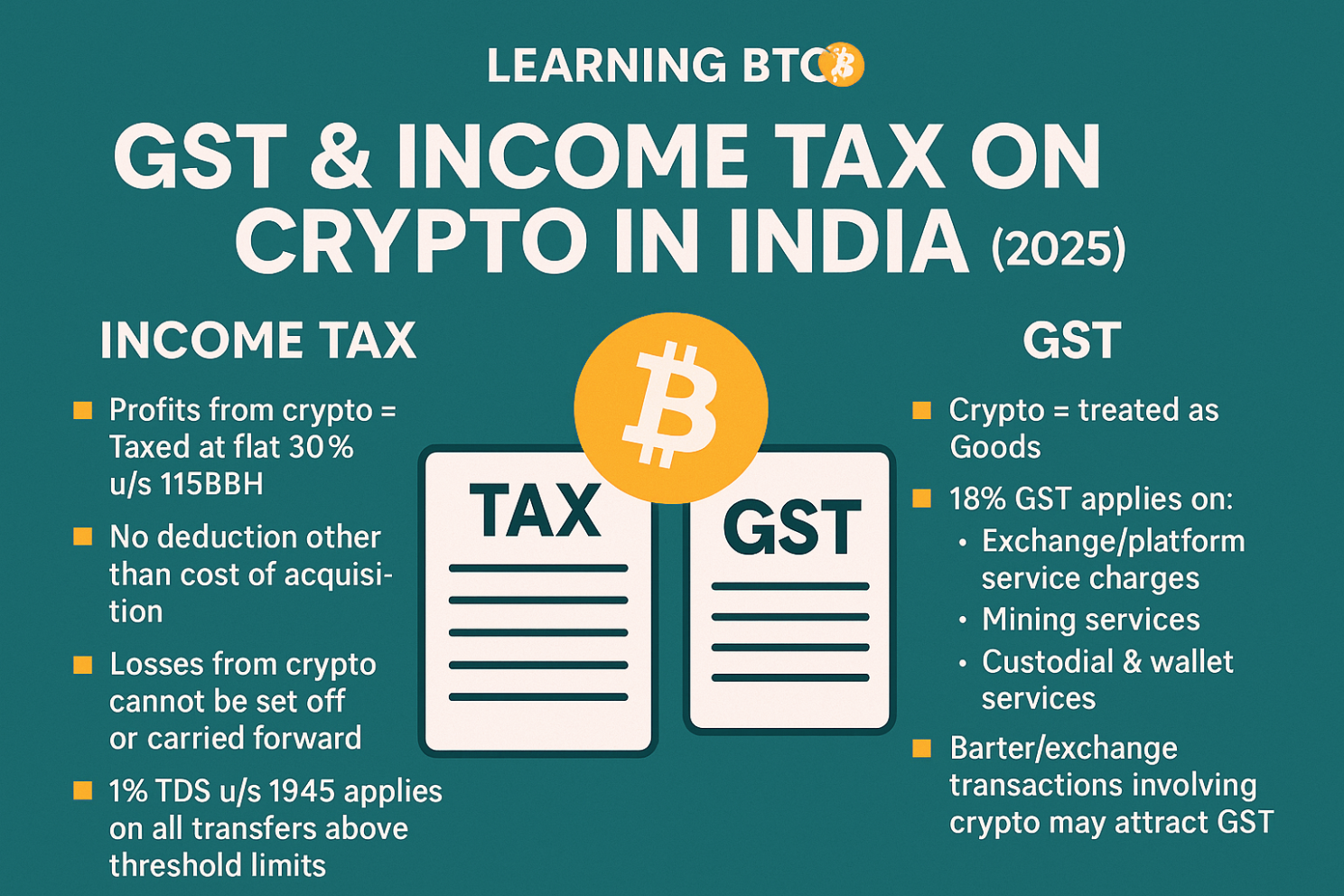

💰 Tax Treatment under Income Tax Act

📌 Section 115BBH: Special Provision for VDAs

- Flat 30% tax on income from transfer of crypto assets

- No deductions allowed (except cost of acquisition)

- No set-off of crypto losses against any other income

- No carry-forward of crypto losses to future years

🔄 Crypto-to-Crypto Swaps = Taxable

Swapping BTC for ETH? Yes, that’s a taxable event. You’re considered to have “sold” BTC and will be taxed on any profit based on its fair market value at the time of exchange.

🧾 Transaction-Wise Reporting in ITR

Income from crypto must be reported under the Schedule VDA in:

- ITR-2 (for capital gains)

- ITR-3 (if classified as business income)

You’ll need to disclose:

- Purchase date & amount

- Sale date & proceeds

- Profit/loss per transaction

💸 1% TDS under Section 194S

From 1st July 2022, 1% TDS is applicable on the transfer of VDAs if:

- Total transfer value exceeds ₹10,000 for general users

- Or ₹50,000 for salaried/small taxpayers

The TDS is deducted before payment and must be reported in Form 26AS and ITR.

📊 Best Practices for Crypto Tax Compliance

✅ Maintain detailed logs of all transactions ✅ Use crypto tax tools (KoinX, TaxNodes, CoinTracker) ✅ Check TDS deductions on exchanges ✅ File returns correctly to avoid penalties

🔍 Final Thoughts

India’s VDA tax regime is strict and unforgiving, but with proper compliance and record-keeping, crypto investors can stay on the right side of the law.

At Learning BTC – ₿ we simplify crypto concepts and regulations for professionals, learners, and investors. Stay informed, stay empowered.

📈 Are you ready for the future of money? 📢 Follow us for more such articles on blockchain, bitcoin, decentralized finance, crypto tax, and Web3 updates.

Disclaimer

The information provided herein is for general informational and educational purposes only and does not constitute investment, financial, legal, or tax advice. While every effort has been made to ensure the accuracy and completeness of the information, the author/advisor makes no guarantee regarding the outcomes or results that may arise from using this information. Investments are subject to market risks. Past performance is not indicative of future results. You should consult a qualified financial advisor and consider your individual objectives, risk tolerance, and financial situation before making any investment decisions.

#CryptoIndia #VirtualDigitalAssets #VDA #Bitcoin #IncomeTaxIndia #Web3 #LearningBTC #CryptoCompliance #TDSonCrypto #SoundMoney #CryptoEducation #Blockchain #FinancialHistory #FutureOfMoney #BlockchainIndia #CryptoTax

Leave a comment